Becoming a Fair Health Care Alliance Merchant

Imagine a QR Code on your reception counter or waiting area. When scanned, your patients will be able to download the Fair Health Care app and create their own account. Because the patient used your QR code to register, they are now “attached” to your practice within the app.

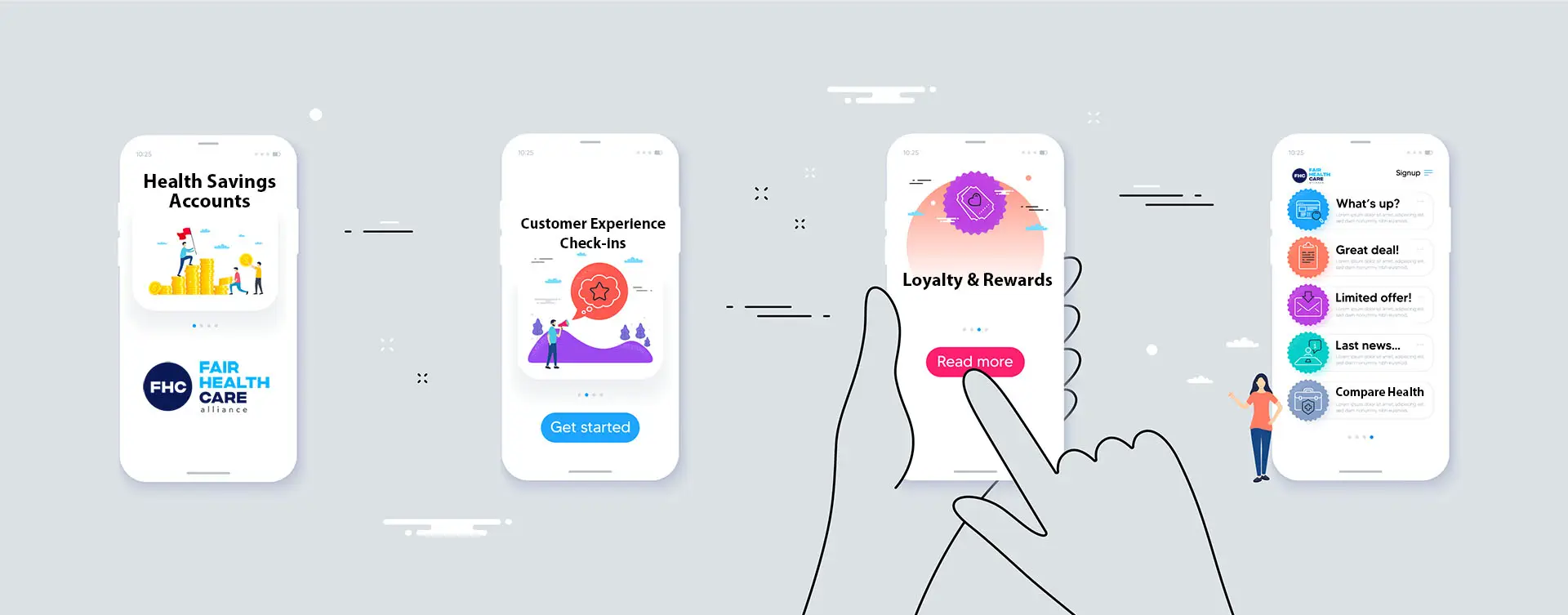

As a Fair Health Care Alliance merchant, you will be able to host all or any of the following helpful solutions to help you strengthen patient retention and increase how often patients visit for continuity of care.

Becoming a Fair Health Care Alliance Merchant

Imagine a QR Code on your reception counter or waiting area. When scanned, your patients will be able to download the Fair Health Care app and create their own account. Because the patient used your QR code to register, they are now “attached” to your practice within the app.

As a Fair Health Care Alliance merchant, you will be able to host all or any of the following helpful solutions to help you strengthen patient retention and increase how often patients visit for continuity of care.

OVERVIEW

A Powerful Retention and Revenue Driving Tool

A HSA is a special-purpose account that allows your patients and their families to save money specifically for medical expenses. Employers can also use it to make health and wellness contributions for their employees.

Your patient has just created their Fair Health Care account by scanning your unique practice QR code. If you’ve included HSA as one of your products, your patient is now encouraged to put aside a monthly contribution into their new Health Savings Account/s to save for future medical bills or gaps, most likely for expenses incurred at your practice. They get to decide how much they save- after all- it’s their money and their account.

Picture these patients attending your practice in the future and first swiping their health insurance card for a partial rebate for the day’s service and then covering the remainder of the gap with their HSA account. The patient feels like they have just had a ‘no-gap’ experience.

Helping your patients budget effectively for unexpected or upcoming healthcare costs is a forward-thinking solution that promotes a positive customer experience and strengthens the relationship between practice and patient. Saving for expenses relating to health management and personal care means more expendable income when a significant or lengthy care plan is recommended by your practitioners. This removes ‘affordability’ as a hurdle when considering how often a patient attends for check-ups and ongoing treatment.

HSA FAQs

The funds are held in a Corporate Collective Investment Vehicle, with an AFSL. The funds are invested with one or more Australian banks in high yield at call treasury facilities.

A HSA will function as a long-term savings tool. Any funds left in your Fair Health Care HSA at the end of the year can be rolled over and will continue to grow. This makes it a valuable investment for future medical expenses or retirement healthcare costs. A HSA can be utilised as a complete ‘self insurance’ model or can work in perfect harmony with a private health insurance hospital and extras policy.

If a patient wishes to withdraw part or all of their Health Savings, they can certainly do so.

People could do this, but they don’t.

Additionally, a Fair Health Care HSA can reward you for saving and investing in your health and wellness. Making contributions to your Health Savings Account and not withdrawing it for non-health related reasons will earn you HSA Points.These Points will provide you with access to exclusive perks and rewards to keep you healthy and financially fit.

A HSA allows individuals to contribute money to the account, which can then be used to pay for qualified medical expenses. Contributions can be made by direct debit, OSKO, or employer payroll deduction.

When it comes time to spend funds from your Fair Health Care HSA, you can do this securely through the FHC App, or by reimbursing yourself for the expenses you’ve paid out of pocket.

One account can be opened for an entire family, or even a multi-generational family so that HSA funds are shared across the family group.

Yes, but it will be clunky and manual if the health provider is not a Fair Health Care Alliance merchant. Automated claims are done through our app straight into your merchant portal for easy processing. For this reason, and because you introduced them to their Fair Health Care HSA, it is in all likelihood that they spend a majority of their savings on your health services.

But doesn’t that make us a kind of “Preferred Provider”? No. We will accept all health practices, health practitioners and health products into our HSA network. Our HSA platform is universal and completely free to use by practice or patient.

It is what fair health care looks like: Simple, helpful and agnostic.

OVERVIEW

We took our old slogan “Avoid losing patients to Preferred Providers” and turned it on its head:

“Become the preferred provider for your own patients” – we like the new one better.

Imagine a completely customisable loyalty program that encourages your patients to stick to your practice long term, be engaged/stay in touch, and visit more often.

If you adopt the Loyalty & Rewards solution into your FHC Merchant Portal, your patients can use the QR code displayed on your counter or in your waiting room to create a digital loyalty card within our app. Think of a coffee-club card where ten stamps gets you a free coffee, and put that idea on steroids.

Everytime that patient comes back for treatment, they can scan your QR code through our app to earn a point. They can also earn points through any number of other behaviours and triggers that you can completely customise within the merchant portal.

You also create a list of rewards that points can be redeemed for – also completely customisable. You decide what benefits, discounts or rewards you would like to offer to drive engagement and retention.

Creating Your Goals

Your patients earn points by completing goals that you define. Goals should align with your customer engagement strategy, business goals, and reflect behaviours that are likely to help improve your business. You might want more patients following your social media pages, or perhaps you’d like your patients to come back more frequently for check-ups or ongoing health maintenance. Maybe you’d like to encourage more of your happy patients to refer friends and family to your practice.

Whatever the behaviour you are trying to drive, you are taking control with our Loyalty and Rewards solution.

Setting Your Rewards

Welcome to the world of Redemptions, where you turn your clinic’s goals into tangible rewards! You decide what makes the most sense to reward your patients with to keep them engaged, active and loyal to your clinic.

It could be free check-ups or no-gap subsequent visits, complimentary classes, store credit, or wellness goodies- the possibilities are endless- and it’s all about tailoring your rewards to what works best for your practice. It’s completely up to you what you give away to drive retention and top-notch customer engagement.

Additional Customer Experience Tools

Built-in to Loyalty & Rewards will be engagement features designed to elevate your clinic’s service quality or NPS score. We have some optional SMS tools that can help retain patients who may have otherwise never come back. With our SMS Survey, you have the power to automatically reach out to your patients after their recent visit to your practice with a customer service check-in. It’s a simple ‘1 for Yes’ or ‘2 for No’ response, which lets patients express their satisfaction instantly. Should someone select ‘No,’ their feedback goes directly to your Notifications area. This proactive approach allows you to address concerns before they escalate to poor Google reviews or lost patients, ensuring events like this are nipped in the bud.

If a patient hasn’t check-in for intervals such as 6, 12, 18, 24 months – we will send them an Engagement SMS through their Fair Health Care App that will remind them how many unused loyalty points they have while encouraging them to come in for a health check-up – complete with a direct link to your online booking form or direct phone number to make a booking then and there.

Loyalty and Rewards FAQs

Technically, Yes.

However, it is in our Terms and Conditions that a practice must ensure they adhere to industry and AHPRA advertising guidelines and best practices that pertain to your industry standards. For example, you shouldn’t recommend or reward any health treatment that is not required or necessary for a patient. By using our software, you retain responsibility to follow any such codes of conduct, association rules or regulations.

We wanted this powerful retention and engagement tool to be accessible and affordable. We want every health practice to be the preferred provider for their own patients.

This solution will only cost $99 per month, per practice. There is a reduction in this cost if you are onboarding multiple practices. Get in touch to discuss multiple practice costs.

Register interest below and our Partnerships Manager will get in touch.

OVERVIEW

Overview

Your patient has just walked out of the treatment room and received the best of your health service treatment. They pull out their health insurance card and make a Hi-Caps claim only to be stunned by how little their health fund is covering of your item-numbered services. Your great customer experience has now been marred by the last touch point between you and your patient at the point of sale…

…but a patient’s health fund rebate has nothing to do with your service, right? Not entirely true.

When a patient is disappointed with their health fund rebate they become at risk of calling their current insurer who may then advise them to change to a “preferred provider” competitor nearby. When this happens, your practice has just lost a patient through no fault or malpractice of your own.

To boot, the last thing they remember when dealing with your practice is the sting of paying a sizable gap – negatively affecting their future choices of how often to visit for ongoing treatment and check-ups.

Before Fair Health Care Alliance, there was no solution to this problem. Now you can take control.

The Solution

Since 2017, FHCA has been partnering with health practices as a reputable service to refer your patients for health insurance comparison. We have specifically partnered with- and recommend health funds and policies- that pay generously at any practice in Australia, not only at Preferred Providers.

We have formally partnered with the Australian Dental Association (ADA) who they themselves refer their users to Fair Health Care Alliance to compare health insurance via their teeth.org.au brand and Time2Switch tool. The ADA has been recommending our service to dentists since 2018. We have just started working in a similar space in the Physiotherapy landscape as well… watch this space.

We will help your patients compare, review, and switch to a health fund that pays more generously for your item-numbered and claimable services. We train your staff and help them learn best practices for engaging patients at the right opportunities, who will then book an appointment call with FHCA through the Merchant Portal.

Health Insurance Referral FAQs

~11.5 Million Aussies have private health insurance (a little over half).

In terms of market share, the top five health insurers in Australia are Medibank, BUPA, HCF, NIB, and HBF. Together, these health funds account for 83% of all insured Australians (Just under 53% are Medibank or BUPA customers alone). When considering that there are over 40 health insurers and brands in Australia, you very quickly see that only 11-12% of the health insurers own 83% of health insurance policyholders! Many health funds in Australia are reputable, mostly Not-for-Profit, with a significant history of insuring Australians from as early as the 1890s, 1930s, and 1950s.

The biggest health insurance companies are not always the highest performing.

Not at all. There are some rules that govern private health insurance in Australia, the most important being a rule called ‘Portability’. Portability dictates that a person can switch health funds without having to re-serve waiting periods. The new health insurer will request a transfer certificate from the previous health fund and waive any and all waiting periods that have already been served.

We handle this process from end-to-end to ensure a smooth transition for your patients. We have direct lines into the back-end managers of our partnered health funds customer service teams, so any rare hiccups are dealt with directly and with attentive escalation.

We have a 5-star review score on Google and Product Review- we encourage you to go have a read of some of these reviews. Our approach to giving health insurance advice is built around a Trust & Transparency philosophy. We teach our advisers to treat each customer like they are helping a friend or family with their health cover.

We are the only health insurance comparator who completely operates in the referral space. We have over 1000 dentists, physiotherapists, chiropractors, mortgage brokers, and financial advisers who trust us with their patients and clients. We understand fully the responsibility and importance of representing someone else’s brand when we give advice to their referred customers.

If we can’t help a patient improve their health cover, we recommend they stay where they are. Many patients appreciate this level of honesty and still rave about us despite no change in their situation. This is just how we do business.

This is a free service for your practice and your patients.

As you would expect, we are remunerated by the private health funds we recommend for introducing to them a new and valued member. As PHIIA Code of Conduct approved health advisers, rules dictate that we are not allowed to be biased when recommending funds from our panel based on commissions paid.

We keep it simple: help the patient get a lower-cost policy and/or significantly higher rebates and annual limits – and not much else to it. We also educate your patients on their new policy, how to decipher the policy documents, and ways they can make their new health insurance policy work for them.

By adopting our Merchant Portal you will have access to our online patient referral form for quick and easy referral by your receptionists at the point of sale. Also, your patients will be able to refer themselves when they create a Fair Health Care account via our app, which will be attached to your practice ( so we know you referred them ). We can also send you DL flyers to hand out.

partners@fairhealthcare.com.au